Published as part of the ECB Economic Bulletin, Issue 3/2024.

This box presents a preliminary assessment of the potential macroeconomic implications for the euro area of the adherence of member countries to the revised rules of the Stability and Growth Pact (SGP) over the period 2025-26.[1] In light of the provisional political agreement reached by the EU co-legislators on 10 February 2024, this box analyses possible implications of the reform for the euro area’s fiscal stance, as well as for the growth and inflation outlook according to the March 2024 ECB staff macroeconomic projections for the euro area.[2] The relevant horizon for the analysis is the period 2025-26, as the revised fiscal rules are expected to take effect from 2025.

The newly agreed fiscal framework relies on a debt sustainability analysis (DSA) to derive medium-term fiscal adjustment trajectories, combined with numerical safeguards in terms of debt reduction and deficit resilience. EU Member States with public debt ratios above 60% of GDP and/or deficits higher than 3% of GDP in 2024 must submit a medium-term fiscal structural plan on the basis of a reference trajectory provided by the European Commission.[3] The adjustment path contained in the national plan will cover a period of four years (2025-28), which is extendable to up to seven years (2025-31) if it is underpinned by commitments to investment and reforms (including those financed under the Recovery and Resilience Facility). The fiscal adjustment, which will be operationalised via multiannual net expenditure trajectories, is set as the maximum resulting from the following two criteria:

- DSA-based trajectory: the debt ratio beyond the chosen adjustment horizon (four to seven years) must be on a plausibly and continuously declining path, as demonstrated via:

- deterministic DSA scenarios (i.e. the debt ratio should decline over a ten-year period along a baseline adjusted for the most demanding of three shock scenarios); and

- stochastic DSA analysis (i.e. the debt ratio should be on a declining path over a five-year horizon with 70% probability).[4]

- Correction under an excessive deficit procedure (EDP): if the budget deficit is higher than 3% of GDP, Member States must correct it by making a minimum annual adjustment of 0.5 percentage points of GDP. This adjustment will relate to the structural primary balance for the transitional period 2025-27, and to the structural balance afterwards.

In addition, two safeguards apply under the SGP’s preventive arm, and these are shared across countries:

- Debt sustainability safeguard: countries with a debt ratio in 2024 that is higher than 90% of GDP must reduce it by a minimum annual average of 1 percentage point of GDP, while those with a debt ratio lower than 90% of GDP must reduce it by 0.5 percentage points of GDP.[5]

- Deficit resilience safeguard: fiscal adjustment must ensure there is a safety margin before the Treaty-based deficit threshold of 3% of GDP is reached, i.e. before the structural balance reaches -1.5% of GDP. To this end, the required annual improvement in the structural primary balance will be 0.4 percentage points of GDP for a four-year adjustment path, and 0.25 percentage points for a seven-year path.

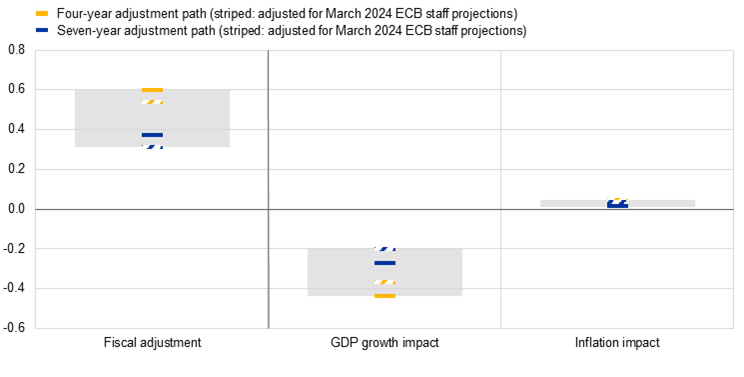

Based on these requirements, several fiscal adjustment scenarios are considered for the euro area over the period 2025-26 (Chart A, left column). The scenarios start from the “face value” adjustment path that satisfies the above requirements based on the European Commission’s Autumn 2023 forecast.[6] The implied annual average adjustment requirements are calibrated in terms of changes in the structural primary balance for the four and seven-year adjustment paths. The analysis also considers these scenarios relative to the March 2024 ECB staff projections baseline (shown as striped lines) by netting out the adjustment – in terms of the change in the structural primary balance – that is already embedded in this baseline.[7]

Chart A

Euro area fiscal adjustment scenarios under the reformed EU fiscal framework and their potential macroeconomic implications over the period 2025-26

(percentage points of GDP and percentage points, annual averages over 2025 and 2026)

Sources: ECB staff calculations, European Commission Autumn 2023 Economic Forecast and March 2024 ECB staff macroeconomic projections for the euro area.

Notes: Fiscal adjustment in percentage points of GDP (the figures do not reflect revisions in ageing costs available after the cut-off date of the calculations in this box). Positive figures denote additional fiscal tightening. The scenarios presented assume that countries do not make use of the margin of deviation allowed under the “control account”. The macroeconomic impacts refer to deviations in percentage points from the baseline. The impacts are calculated per year (and also reflect lagged effects of the fiscal shock in the preceding year) and then averaged across 2025 and 2026. The simulation results for the euro area aggregate are averages across a range of three ECB and Eurosystem macroeconomic models used in the projections. Simulations are conducted at individual country level and then aggregated at the euro area level with two of the models, while with the other model the fiscal shock is first aggregated at the euro area level before its macro effects are simulated.

In terms of the impact on the euro area aggregate fiscal stance, adherence to the reformed EU fiscal framework would, overall, imply some additional fiscal tightening over 2025-26 compared with the March 2024 ECB staff projections baseline. Depending on the length of the adjustment period (four to seven years), at face value the scenarios assume that governments would take consolidation measures under the new framework amounting to 0.4 to 0.6 percentage points of GDP, on average, over 2025-26, while in the scenario adjusted for the effort already included in the ECB baseline, these consolidation measures would amount to between 0.3 and 0.5 percentage points of GDP.[8] In particular, the scenarios that assume that all countries would opt for a four-year adjustment period can be considered as upper bounds for the 2025-26 period.

The fiscal scenarios considered in this box imply some downside risks to growth, although these are rather small, while the impact on inflation is limited (Chart A, middle and right columns). The simulations consider a country-specific composition of fiscal adjustment whenever reliable information exists. This composition is tilted towards cuts in public transfers and government consumption. Otherwise, a standardised composition is assumed, with an equal share for four fiscal instruments (fiscal transfers, government consumption, indirect taxes, and direct taxes and social security contributions). Given that government investment is intended to be preserved under the revised fiscal framework (especially when taking into account public investment and structural reforms extending over a seven-year adjustment horizon), this instrument is excluded from the assumed consolidation measures. Overall, at the euro area aggregate level, the scenarios assume that 70% of the consolidation will be implemented on the expenditure side and 30% on the revenue side (with less than half of the latter, or 13% of the total, being implemented via net indirect taxes). Given this composition, the scenarios using the March 2024 ECB staff projections as a direct benchmark would entail only moderate GDP effects, especially when the adjustment is over a seven-year horizon. The inflation effects are generally limited. The very small positive inflation effect is due to the fact that the increase in (net) indirect taxes (which can originate from higher indirect taxes and/or cuts in product subsidies) has an immediate, albeit temporary, positive effect on inflation, while the demand effect of changes in other fiscal instruments (dampening inflation) is smaller and materialises more gradually.

The size and nature of the fiscal adjustment requirements and, correspondingly, the macroeconomic effects presented in this exercise are surrounded by significant uncertainty. This uncertainty stems mainly from: (i) the fiscal adjustment requirements, as well as the timing and composition of the consolidation, which still need to be agreed in national fiscal structural plans following bilateral discussions between Member States and the Commission; (ii) practical implementation risks; (iii) potential changes in the Commission’s forecast (Spring 2024 versus Autumn 2023); and (iv) other macroeconomic and financial factors. As regards implementation, risks can also stem from the flexibility allowed ex post if countries make use of the margin of deviation allowed under the “control account”. The control account has been introduced to keep track of cumulative upward or downward deviations of actual net expenditure from the agreed net expenditure path, recording a debit when the actual annual net expenditure in a country is above the agreed net expenditure path, and a credit when it is below this path. When the cumulated balance of the control account exceeds 0.6% of GDP, the Commission may launch an EDP. An EDP may also be launched if the marginal debit in the control account exceeds 0.3% in a single year.[9]

In its statement on the fiscal policy orientation for 2025, the Eurogroup stressed its commitment to ensure that the new fiscal framework is implemented consistently and swiftly.[10] This should contribute to improving the sustainability of public finances through sufficient and differentiated debt reduction paths across countries, supported by future primary surpluses. As shown in this box, for the period 2025-26 the estimated inflation impact is limited across all scenarios, while there are some downside risks to short-term growth if the adjustment requirements are delivered over a short time period and in full (on top of the fiscal measures already in place). These growth effects would appear to be more limited when factoring in the available flexibility provided by the revised fiscal framework.[11] In particular, fiscal adjustment requirements may be smoothed over time to support growth via incentives for public investment and structural reforms. Finally, possible confidence effects, deriving for instance from lower sovereign bond yield spreads or higher potential growth prospects (not accounted for in this box), could temper the short-term downside impact on growth, especially for the high debt countries.

Following the European Commission’s legislative proposals of April 2023, the ECOFIN Council reached agreement on a reform of the fiscal rules underpinning the EU’s Stability and Growth Pact on 20 December 2023. For more details, see the Council of the EU press release of 21 December and the accompanying draft Council regulations. While keeping the Council compromise largely intact, the February provisional agreement, which is still pending adoption by the European Parliament, envisages excluding national expenditure on the co-financing of EU-funded programmes from the expenditure path in order to create more incentives to invest. This exclusion does not affect the quantitative estimates in this box.

See “ECB staff macroeconomic projections for the euro area, March 2024”, published on the ECB’s website on 7 March 2024.

Countries whose starting deficit level (in 2024) is below 3% of GDP and starting debt level is below 60% of GDP will, upon request, only receive “technical information” from the Commission as guidance to draw up their national medium-term fiscal structural plans. According to the European Commission’s Autumn 2023 Economic Forecast, these countries are Estonia, Ireland, Croatia, Lithuania, Luxembourg and the Netherlands. In the simulations considered in this box, these countries are assumed to request the technical information from the Commission and to make additional consolidation efforts if required by the new framework.

For the deterministic DSA scenarios, the shocks are designed as: (1) a higher interest rate-growth differential (r-g); (2) a financial stress event; and (3) a lower structural primary balance (SPB) path. The most binding in almost all cases is the r-g shock, conceived as a 1 percentage point higher r-g (0.5 percentage point higher interest rate and 0.5 percentage point lower growth). The financial stress event embeds a 1 percentage point higher marginal interest rate shock, and the SPB scenario a lower (-1 percentage point of GDP) SPB path.

This condition, which is specifically intended for high debt countries to ensure a minimum level of debt reduction, is applicable over the adjustment period (2025 to 2028 or 2031). However, in the case of countries under deficit-based EDP, it is only applicable after the year in which the EDP is abrogated.

The provisional agreement among EU co-legislators envisages national medium-term fiscal-structural plans being submitted to Member States by 20 September 2024. The Commission would transmit prior guidance, in the form of reference trajectories, to Member States by 21 June 2024 at the latest. These reference trajectories would be based on the Commission’s Spring 2024 Economic Forecast.

This adjustment amounts to 0.13 percentage points of GDP in 2025 and is close to zero in 2026. The scenarios relative to the ECB baseline also take into account any changes in fiscal measures since the December 2023 Eurosystem staff projections, whose cut-off date is close to the Commission’s Autumn Economic Forecast. Finally, according to ECB calculations, the average annual effort implied by the change in the structural primary balance and the expenditure benchmark (the latter will be used in specifying the measures of the respective plans) are similar at the euro area aggregate level.

The “face value” scenarios assume that governments take new consolidation measures in addition to those already included in the ECB projections baseline.

In addition, the low debt and low deficit countries (see footnote 3) may not request a technical information path from the Commission. In this case, they will not be bound by adjustment requirements, which could further reduce the size of the fiscal adjustment considered in this box.

See “Eurogroup statement on the fiscal policy orientation for 2025”.

However, delays in fiscal adjustment, and thus in lowering debt levels, would result in higher adjustment requirements in the future.